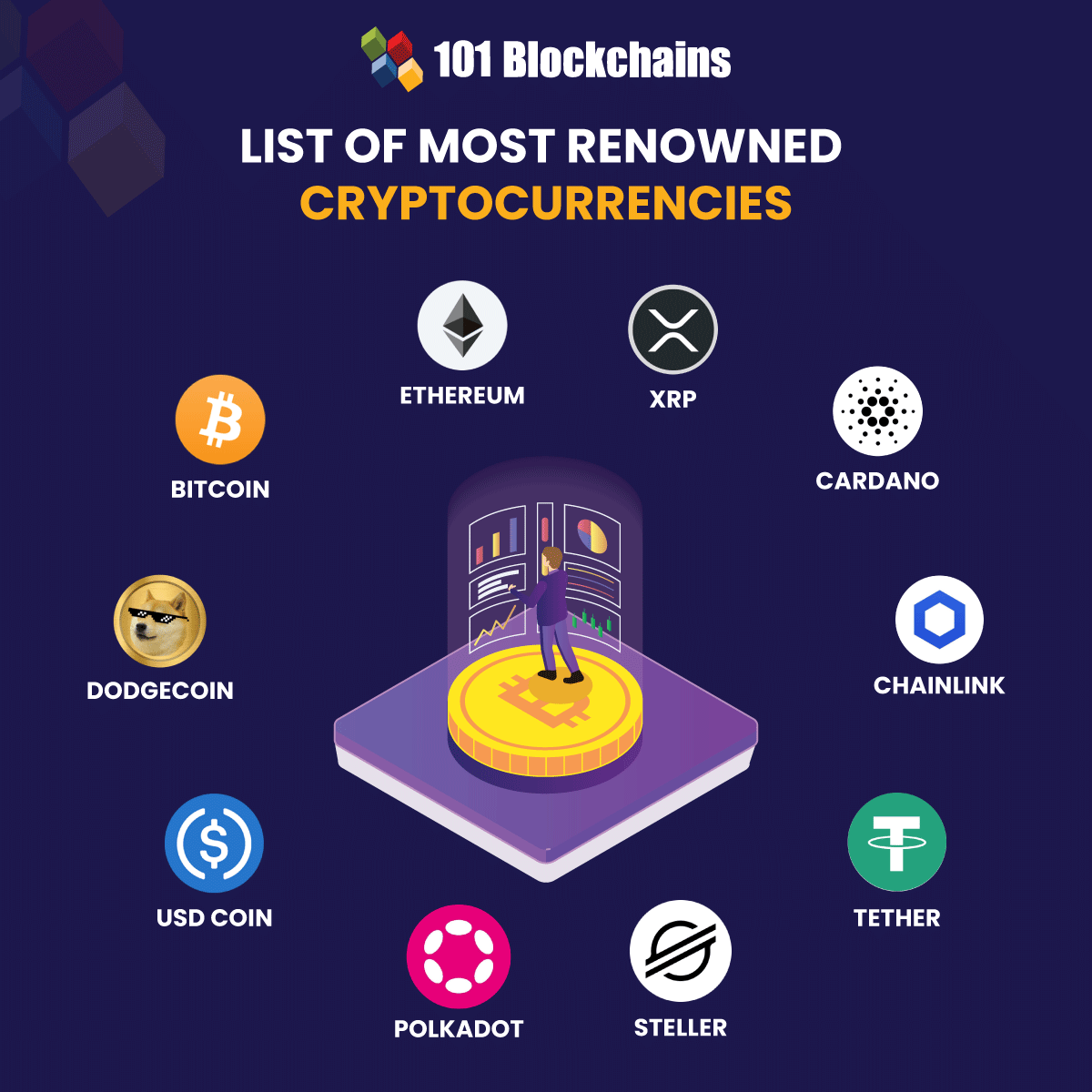

Cryptocurrency to invest in

De totale voorraad is momenteel 589 biljoen SHIB. De marktkapitalisatie van SHIB bij een prijs van €1 zou dan €589 biljoen bedragen. Dat is wel heel onrealistisch, aangezien de totale marktkapitalisatie van alle crypto op dit moment €2,87 biljoen is.< https://website-wisdom.com/ /p>

BONE heeft een vaste voorraad van 250 miljoen tokens en is het derde token op het ecosysteem. BONE is het governance token van het netwerk, dat stemrecht geeft over de ontwikkelingen van het netwerk. BONE wordt daarnaast ook uitgekeerd als beloning voor onder meer crypto staking op ShibaSwap.

De oprichter van Shiba Inu Coin is bekend onder de naam ‘Ryoshi’. Dit is echter een pseudoniem. Wie er echt achter de munt zit is niet duidelijk. Net als Satoshi Nakamoto, de mysterieuze oprichter van Bitcoin, is Ryoshi nog steeds anoniem.

Top 10 cryptocurrency

The closest second to Bitcoin is Ethereum, and its token which is called “Ether.” The Ethereum network is intended to replace traditional financial services firms like banks and brokerages by using decentralized applications, commonly called “DeFi,” for financial applications. Ether is the fuel that is required to run transactions on the Ethereum blockchain.

The closest second to Bitcoin is Ethereum, and its token which is called “Ether.” The Ethereum network is intended to replace traditional financial services firms like banks and brokerages by using decentralized applications, commonly called “DeFi,” for financial applications. Ether is the fuel that is required to run transactions on the Ethereum blockchain.

Solana is a high-performance blockchain renowned for its ultra-fast speeds and low transaction costs. For these qualities, Solana is one of the favorite networks for decentralized finance (DeFi) projects and non-fungible tokens (NFTs).

JetBolt is a young altcoin that has sold over 66 million tokens since its presale debut in August 2024, making it one of the contenders for the top crypto coins. What’s fueling JetBolt’s soaring presale numbers? This can be attributed to JetBolt’s exciting and revolutionary features.

There are also blockchain-based tokens that are meant to serve a different purpose from that of money. One example could be a token issued as part of an initial coin offering (ICO) that represents a stake in a blockchain or decentralized finance (DeFi) project. If the tokens are linked to the value of the company or project, they can be called security tokens (as in securities like stocks, not safety).

Bankrate is always editorially independent. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here’s an explanation for how we make money . Our Bankrate promise is to ensure everything we publish is objective, accurate and trustworthy.

Cryptocurrency prices live

Discover price changes and market trends at a glance. Our heatmap offers a unique and intuitive way to understand market moves, while our charts gives a more detailed view on coins, making it easy to spot top gainers and losers on various timeframes such as hourly, daily and weekly.

The data presented is for informational purposes only. Some data is provided by CoinMarketCap and is shown on an “as is” basis, without representation or warranty of any kind. Please view our General Risk Warning for more information.

A few years ago, the idea that a publicly traded company might hold Bitcoin on its balance sheets seemed highly laughable. The flagship cryptocurrency was considered to be too volatile to be adopted by any serious business. Many top investors, including Warren Buffett, labeled the asset a “bubble waiting to pop.”

On October 31, 2008, Nakamoto published Bitcoin’s whitepaper, which described in detail how a peer-to-peer, online currency could be implemented. They proposed to use a decentralized ledger of transactions packaged in batches (called “blocks”) and secured by cryptographic algorithms — the whole system would later be dubbed “blockchain.”

New cryptocurrency

Similar criticism was echoed by Auckland University of Technology cryptocurrency specialist and senior lecturer Jeff Nijsse and University of Otago political scientist Professor Robert Patman, who described it as government overreach and described it as inconsistent with international law. Since the Cook Islands is an associated state that is part of the Realm of New Zealand, Patman said that the law would have “implications for New Zealand’s governance arrangements.” A spokesperson for New Zealand Foreign Minister Winston Peters confirmed that New Zealand officials were discussing the legislation with their Cook Islands counterparts. Cook Islands Prime Minister Mark Brown defended the legislation as part of the territory’s fight against international cybercrime.

According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a “balanced approach” to ICO projects and would allow “legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system.” In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.

Within a proof-of-work system such as bitcoin, the safety, integrity, and balance of ledgers are maintained by a community of mutually distrustful parties referred to as miners. Miners use their computers to help validate and timestamp transactions, adding them to the ledger in accordance with a particular timestamping scheme. In a proof-of-stake blockchain, transactions are validated by holders of the associated cryptocurrency, sometimes grouped together in stake pools.

The IMF is seeking a coordinated, consistent and comprehensive approach to supervising cryptocurrencies. Tobias Adrian, the IMF’s financial counsellor and head of its monetary and capital markets department said in a January 2022 interview that “Agreeing global regulations is never quick. But if we start now, we can achieve the goal of maintaining financial stability while also enjoying the benefits which the underlying technological innovations bring,”

In June 2021, El Salvador became the first country to accept bitcoin as legal tender, after the Legislative Assembly had voted 62–22 to pass a bill submitted by President Nayib Bukele classifying the cryptocurrency as such.