Cryptocurrency

Cardano เป็นหนึ่งในบล็อกเชนที่ใหญ่ที่สุดที่ประสบความสำเร็จในการใช้กลไกฉันทามติพิสูจน์การเดิมพัน ซึ่งใช้พลังงานน้อยกว่าอัลกอริธึมการพิสูจน์การทำงานที่อาศัย Bitcoin แม้ว่า Ethereum ที่มีขนาดใหญ่กว่าจะได้รับการอัปเกรดเป็น PoS แต่การเปลี่ยนแปลงนี้เกิดขึ้นทีละน้อยเท่านั้น

Cardano ก่อตั้งขึ้นในปี 2017 และโทเคน ADA ได้รับการออกแบบมาเพื่อให้เจ้าของสามารถมีส่วนร่วมในการทำงานของเครือข่ายได้ ด้วยเหตุนี้ผู้ที่ถือสกุลเงินดิจิทัลจึงมีสิทธิลงคะแนนเสียงเกี่ยวกับการเปลี่ยนแปลงใด ๆ ที่เสนอในซอฟต์แวร์

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. https://facebookanswerman.com/ From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

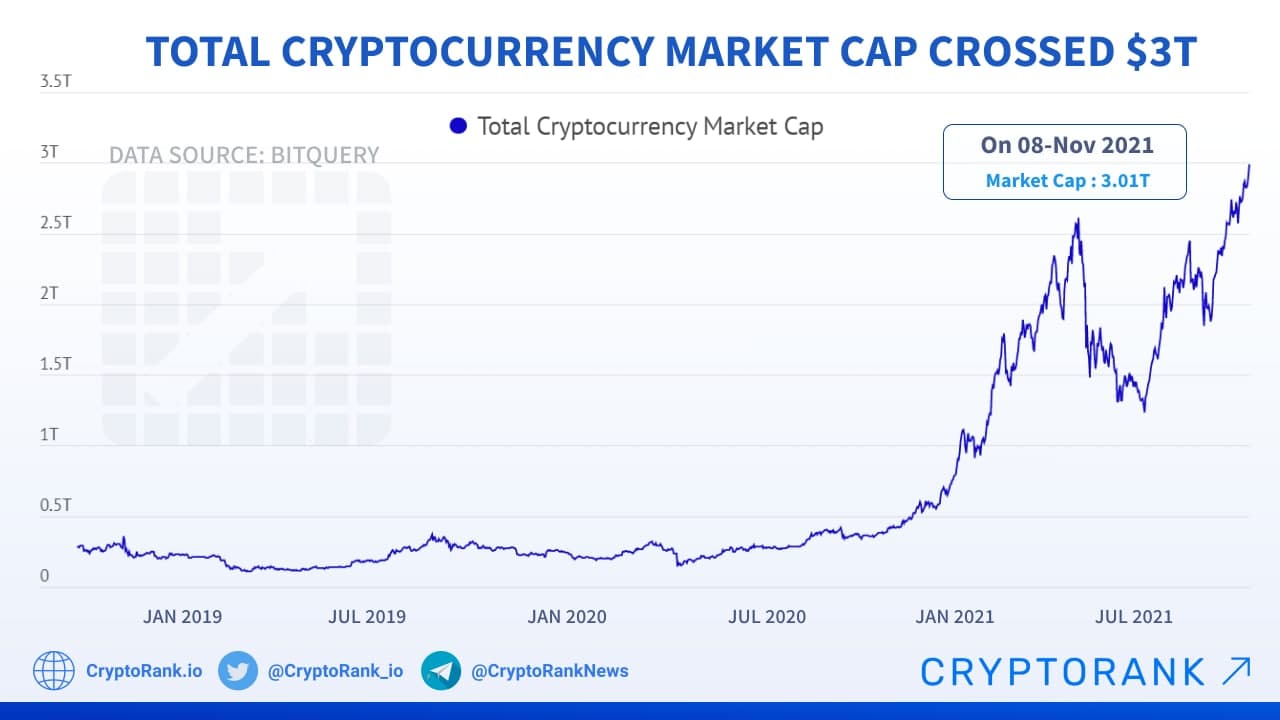

Cryptocurrency market cap

It has managed to create a global community and give birth to an entirely new industry of millions of enthusiasts who create, invest in, trade and use Bitcoin and other cryptocurrencies in their everyday lives. The emergence of the first cryptocurrency has created a conceptual and technological basis that subsequently inspired the development of thousands of competing projects.

Yes, you can access historical cryptocurrency market data via the /v1/global-metrics/quotes/historical API endpoint. This allows you to retrieve past global market metrics, such as market capitalization and Bitcoin dominance, based on specified time ranges and intervals.

A soft fork is a change to the Bitcoin protocol wherein only previously valid blocks/transactions are made invalid. Since old nodes will recognise the new blocks as valid, a soft fork is backward-compatible. This kind of fork requires only a majority of the miners upgrading to enforce the new rules.

As compensation for spending their computational resources, the miners receive rewards for every block that they successfully add to the blockchain. At the moment of Bitcoin’s launch, the reward was 50 bitcoins per block: this number gets halved with every 210,000 new blocks mined — which takes the network roughly four years. As of 2020, the block reward has been halved three times and comprises 6.25 bitcoins.

Op het moment van schrijven schatten we dat er meer dan 2 miljoen paren worden verhandeld, bestaande uit munten, tokens en projecten in de wereldwijde muntmarkt. Zoals hierboven vermeld, hebben we een due diligence proces dat we toepassen op nieuwe munten voordat ze worden genoteerd. Dit proces controleert hoeveel van de cryptocurrencies uit de wereldmarkt vertegenwoordigd zijn op onze site.

Cryptocurrency meaning

Node owners are either volunteers, those hosted by the organization or body responsible for developing the cryptocurrency blockchain network technology, or those who are enticed to host a node to receive rewards from hosting the node network.

With crypto assets, fundamental metrics such as a P/E ratio, dividend rate, or yield-to-maturity do not apply. Instead, HODLers may invest in the “scarcity value” of a finite crypto such as Bitcoin—similar to the way investors view gold and precious metals as assets that may hold their value amid inflation. Learn more about crypto HODLing.

Bitcoin was the first of the many cryptocurrencies that exist today. Following its introduction in 2009, developers began to create other variants of cryptocurrencies based on the technology powering the Bitcoin network. In most cases, the cryptocurrencies were designed to improve upon the standards set by Bitcoin. That is why other cryptocurrencies that came after bitcoin are collectively called “altcoins” from the phrase “alternatives to bitcoin.” Prominent examples are:

According to Alan Feuer of The New York Times, libertarians and anarcho-capitalists were attracted to the philosophical idea behind bitcoin. Early bitcoin supporter Roger Ver said: “At first, almost everyone who got involved did so for philosophical reasons. We saw bitcoin as a great idea, as a way to separate money from the state.” Economist Paul Krugman argues that cryptocurrencies like bitcoin are “something of a cult” based in “paranoid fantasies” of government power.

The term “physical bitcoin” is used in the finance industry when investment funds that hold crypto purchased from crypto exchanges put their crypto holdings in a specialised bank called a “custodian”.

With more people entering the world of virtual currency, generating hashes for validation has become more complex over time, forcing miners to invest increasingly large sums of money to improve computing performance. Consequently, the reward for finding a hash has diminished and often does not justify the investment in equipment and cooling facilities (to mitigate the heat the equipment produces) and the electricity required to run them. Popular regions for mining include those with inexpensive electricity, a cold climate, and jurisdictions with clear and conducive regulations. By July 2019, bitcoin’s electricity consumption was estimated to be approximately 7 gigawatts, around 0.2% of the global total, or equivalent to the energy consumed nationally by Switzerland.